Competition is fierce, clients are more demanding than ever, and on top of it all, there are talks of a recession making everyone hyper-sensitive to price. Under these conditions, you cannot increase prices and you had better have a very good reason for adjusting your pricing strategy.

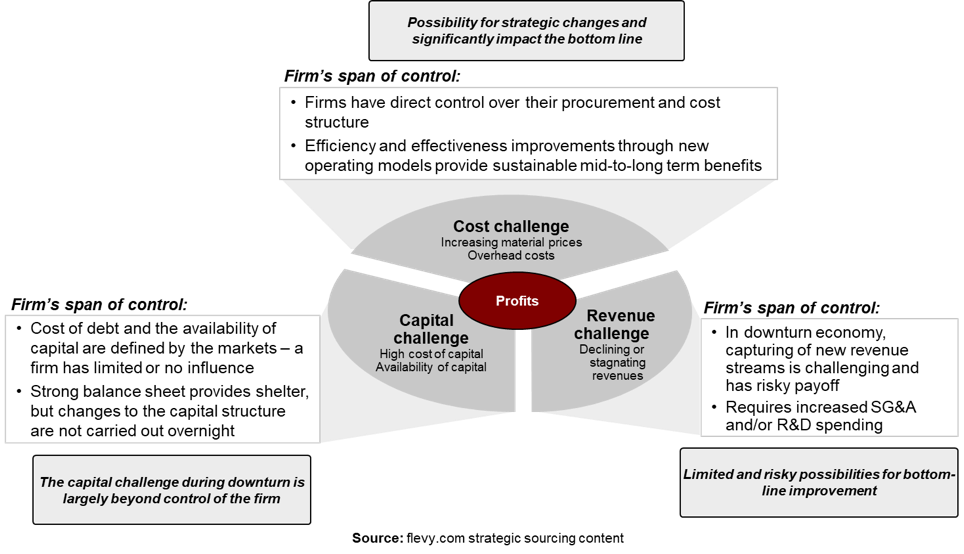

When improving the margin on the P&L is required, there are usually three areas that a company looks into:

- Revenue and pricing: trying to get more revenue for the same product or service (adjusting prices), or segregating the service into tiers (“up selling”) or other tactics that bring a risk that may or may not materialize, depending on the company’s own position within the marketplace. Also, new products and services could bring more revenue, but this will initially require an amount of investment and time for experimentation, which means it will not serve as a short to mid-term measure.

- Cost of Capital or Fresh Resources: Depending on the country and type of market you operate in, there might be some help available in the form of subsidies or special grants, or debt conversion into lower interest or lengthier terms to lower cash flow needs, or other financial tools, but this is not something you can usually influence, it’s either there for you or not. You can seize the opportunity but you cannot influence the opportunity itself.

- Lowering your operational cost or production cost: Trying to improve your cost position in some way (not financial cost, but the “run cost” of the operation) so that selling the same you get more income at the end of the day.

The diagram below depicts these three possible avenues for improvement, as well as the challenges usually associated with them.

A company’s span of control is limited and when looking for improved margins, people look to internal factors first, simply because this is where the company has most control and faster execution of any changes. But cost cutting in the wrong way can be costly too. You need to look for sustainable changes that deliver to the bottom line with minimum disruption to your operation, not only short term, but in the long run.

A company’s span of control is limited and when looking for improved margins, people look to internal factors first, simply because this is where the company has most control and faster execution of any changes. But cost cutting in the wrong way can be costly too. You need to look for sustainable changes that deliver to the bottom line with minimum disruption to your operation, not only short term, but in the long run.

Inexperienced procurement “cost cutting” has to do with ceasing to purchase something that you used to purchase or had plans to contract. There might be some investigation into a different supplier that gives you cheaper pricing, but you don’t know about their quality and reliability. Sometimes companies just delay the purchases “until things get better” or until the need is just plain urgent. All those measures, carry the risk of strangling the business or delaying initiatives that then won’t get the results you expected in the timeframe they were set for.

Strategic Procurement: an often overlooked approach

An often overlooked approach, is what is called strategic procurement, which deals with how we purchase in a non-transactional matter. It deals with first understanding better what you buy, why, when and how, and then looking at the impact (risk) of scarcity of each thing you buy (each SKU or purchase category), as well as evaluating the leverage you can have as a buyer with the different suppliers. All these analyses require some preparation and data wrangling that can encounter barriers:

- a) Data might not be readily available,

- b) Purchasing personnel might be more operational and unfamiliar with the strategic procurement methodology, and thus even if the data is there, processing it to accomplish a spend analysis might be new territory for your procurement function.

- c) Your decision making culture may not be to place facts and data analysis first with the highest priority when taking a decision. Perhaps your more common tools are past experience and subjective managerial criteria, although highly qualified, but still subjective.

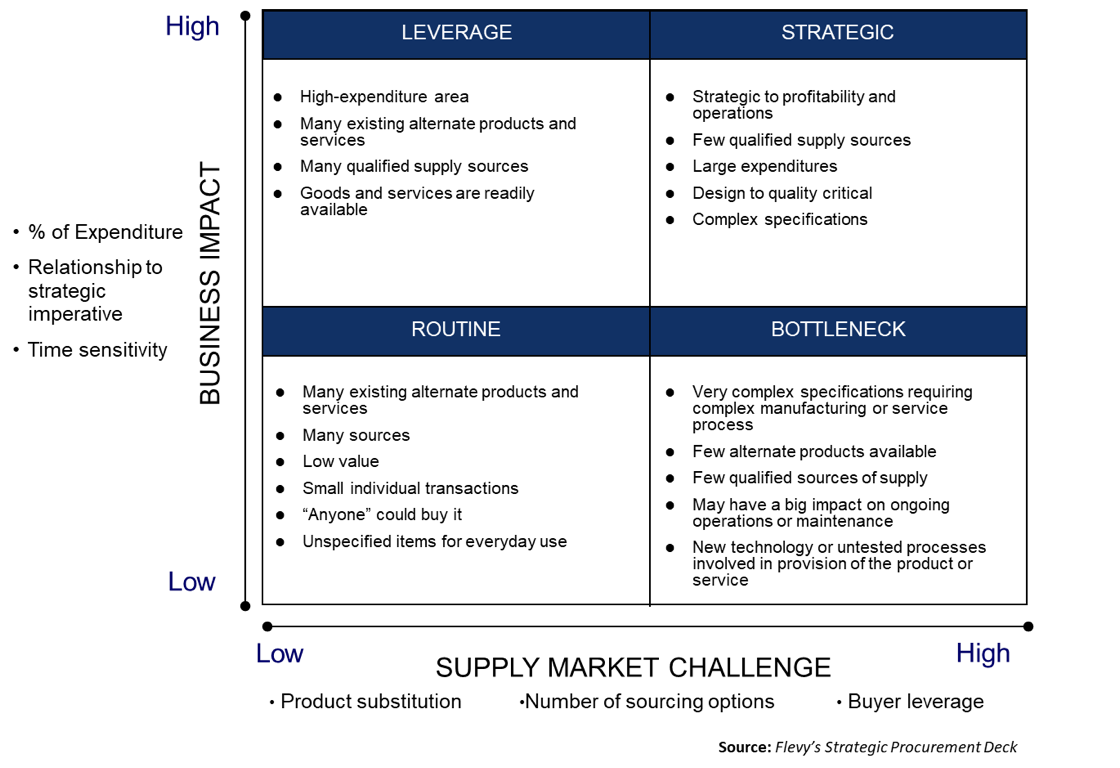

Strategic Procurement is all about purchasing better, by purchasing category or SKU (stock keeping unit – per individual type of item). You need to understand the supply market for each purchase category and also how important these goods or services are for your operation. Having this understanding allows the procurement area to understand that not all SKUs have the same importance, the same risk, and the same market conditions, which is the first step in changing the strategies for buying based on the criticality of the SKU or the supply conditions in the market.

Many companies have simplified their purchasing into “one size fits all” rules and policies that treat most SKUs as if they were the same, had the same importance or impact for the business. When there are variations or exceptions, they are either historical or circumstantial.

The potential benefit of doing your procurement more strategically cannot be overstated: A reduction of $1 in the purchasing cost can be equal to an increase of up to $6 or $7 in new sales. It would depend on your company’s own specific cost structure, but do the arithmetic with your own P&L.

So, although this strategic initiative is valid in every context of daily business, when you as a company are limited in terms of what you can do with the income side, on the expense cycle revising your procurement can prove a hidden gem for improvement.

How to start with your strategic procurement analysis

In very general terms, this strategic analysis requires the following process:

- Spend Analysis: first define how many purchase categories you have and their characteristics (local raw materials, imported raw materials, marketing supplies, social media marketing services, building maintenance, fleet maintenance, office supplies, etc.). How many categories you will define for your spend depends on what makes sense for your particular industry and company. Collect the internal baseline spend for at least the last 12 months and analyze the demand cycle. Try to estimate the total cost of ownership of the different categories.

- Market Analysis: Research your supplier market to determine how many suppliers are in each category (it does not have to be exact, rather understand if it’s a very fragmented market, if there are only a few players or if a specific category is supplied only by one or two providers). This analysis will help you understand how much leverage as a buyer you may have for each purchase category. In a very fragmented market, a supplier can be substituted more easily and thus the risk of scarcity is much less than in another category where there are only one or two suppliers.

- Strategy development: This task is at the core of doing procurement more strategically. It means analyzing and combining the criticality of a category or a specific SKU for you as a buyer with the criticality of the marketplace for this category or SKU. Stated differently: identify which categories are critical for your operation and which ones are not that important for keeping the business running and compare these with how difficult to buy or how risky it will be if the supplier of that category would have an event that would cause scarcity with its supply. Usually, this process would lead to categorize your SKUs into one of 4 different categories, which are shown in the diagram below:

Based on that categorization, you need to identify specific strategies and policies to buy each type of category or SKU in the most efficient and least risky manner for you. There will also be misalignments on how you currently buy some SKUs and how you define you should be buying them strategically. These misalignments will trigger actionable tasks to re-align the procurement of these categories or specific SKUs.

Based on that categorization, you need to identify specific strategies and policies to buy each type of category or SKU in the most efficient and least risky manner for you. There will also be misalignments on how you currently buy some SKUs and how you define you should be buying them strategically. These misalignments will trigger actionable tasks to re-align the procurement of these categories or specific SKUs.

- Supplier Negotiations: This could be a slower process, because with some suppliers you may have some leverage or the re-alignment could be done easily, some suppliers may not need a change or perhaps only a slight one, and in other cases you may not have the influence or there might be previous contracts in effect that you need to wait for their renewal to re-negotiate. Also, you may need to co-work with your suppliers to get a mutual advantage on how you purchase from them.

From this step onwards, there are usually “waves” for the next steps in order to better manage and schedule when or where you negotiate, re-negotiate or do a complete request for proposal that ends with a new supplier or group of suppliers. These ‘waves’ or phases allow you to handle in blocks your suppliers until you cover 80/20 of your most critical supplier re-alignment.

Once you have the desired scenario in place for a category, you re-analyze that category to identify gains with respect to the original situation, re-assess the Total Cost of Ownership (called “TCO”) and start implementing the strategy measuring the ongoing spend and savings as you move forward.

The following diagram is a very high level depiction of that process for illustrative purposes:

This approach provides a method the procurement area can follow for improving its cost base in a sustainable manner, that will impact the bottom line, improving margins with minimum disruption to the day to day operation or independently of other efforts the company may be doing in sales, operations, production or distribution.

There’s been quite a lot of thought and discussion regarding how the future is going to impact the procurement function and how strategic procurement needs to evolve in order to take into consideration this new era of digitization and capabilities we call “Industry 4.0” (thus transforming procurement into “digital procurement” or Procurement 4.0 as some have called it). A.T Kearney’s Procurement Chessboard is one such model, but is not focus for this commentary.

Regardless of where you are in your procurement function, what your current capabilities are right now or in what industry you are competing, the reality is that for every dollar you optimize in your purchasing cost, you earn as much as a sale 3X to 6X times that amount.

Add comment