Perhaps the last person to credibly make the case that Mexico City was a hidden gem — its tremendous potential not fully accounted for on the global sourcing map — was Hernan Cortes. The reason for this is fairly clear. Even 496 years ago the Aztec capital was enormous, larger than Paris and 20 times bigger than London. Today Mexico City is a monster, “un monstruo,” says my Uber driver as we make our way through the neighborhood of Condesa. The capital’s strength as a delivery destination is often drowned out by the city’s size and the diversity of its economy.

But Mexico City enjoys the same benefits that have made Mexico a leading global destination for BPO and ITO. Mexico has a large educated workforce that speaks proficient English and possesses the full array of tech skills. And Mexico can deploy these strengths to full effect because, as a source country, its strategic geographic location is unrivaled — it borders the United States and has similar time zones with its main trading partner. All these critical business attributes reside in a country with a track record of sound macroeconomic policy and low inflation.

The Nearshore Americas IT Wage Study

Mexico City has at least one key advantage over its peers. A research report recently published by Nearshore Americas revealed, among other insights, that Mexico City has among the lowest wages for software developers and IT professionals in the region. Nearshore Americas examined the software labor market into five key roles throughout Latin America (front-end developer, back-end developer, UX/UI designer, system administrator, and project manager) and further broke down the IT roles by experience levels.

Some of the study’s findings support widely held notions about wages. For instance, wages for front-end developers across Mexico City, Monterrey, Guadalajara, and San Jose, Costa Rica, are largely in line, varying by just 5.4% between markets. Only in Guatemala City do front-end developers earn significantly less.

A research report recently published by Nearshore Americas revealed, among other insights, that Mexico City has among the lowest wages for software developers and IT professionals in the region.

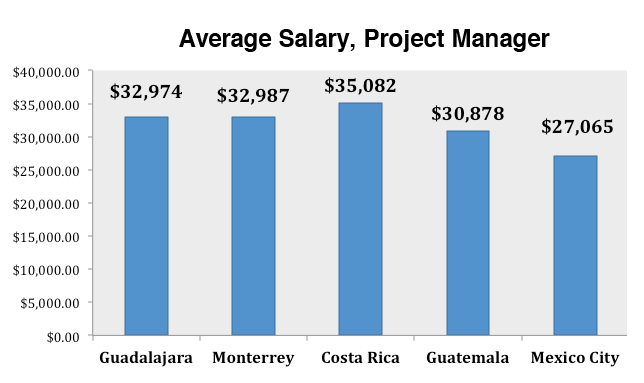

However, many of the study’s insights question long-held views and expose a variety of misconceptions on wages. In fact, as the IT job becomes more advanced, Mexico City’s advantage over other markets becomes clear. Among the IT jobs studied, it’s not really a surprise that project managers command the highest salary: They tend to have several years of experience. In Mexico City, wages for project managers average less than $28,000 a year, the lowest of the markets examined by Nearshore Americas. By contrast, in other markets firms reported pay in a relatively tight range of $31,000 to $34,000 in 2015. This advantage is only enhanced by the fact that Mexico City has among the lowest average overall cost — including bonuses — for employing IT talent of all markets in the region.

The Regional Context

As once-favored destinations in South America lose their shine, Mexico City’s strengths stand out even more. Brazil and Argentina are struggling due to high wage costs, increasingly complicated regulatory environments, and unbalanced economies. Meanwhile Costa Rica, once the poster child of nearshore success, is coming to terms with the effects of major services firms leaving the country in recent years.

Atop these destination shifts, the BPO/ITO industry is being remade thanks to the disruptive role of technology. From automation-based customer response to the deployment of big data for predictive analytics, the collective mindset of the outsourcing industry is changing. Destination selection warrants more caution than ever. In this light, it’s hardly surprising that the value of outsourcing contracts has stagnated over the past year, even as the volume of contracts reaches new highs, as noted in ISG’s Q3 2015 report.

Despite these challenges, Mexico’s BPO/ITO sector continues expanding. Overall, fewer call centers have been opened in 2015 than in 2014. While Mexico is not immune to this regional slowdown, the country will account for 20% of new call centers opened in 2015 — more than any other Latin American market, according to Everest Group.

Mexico City Rediscovered?

It remains to be seen how Mexico City’s growth as a delivery destination will impact Monterrey, Guadalajara, or smaller Mexican markets. From an industry perspective, any movement of activity back toward the capital is usually greeted with frustration, proof that an attempt to establish a second city for outsourcing delivery has failed.

Any movement of activity back toward the capital is usually greeted with frustration, proof that an attempt to establish a second city for outsourcing delivery has failed. That will not be the case here; Guadalajara and Monterrey will remain major destinations regardless of Mexico City’s growth.

That will not be the case here; Guadalajara and Monterrey will remain major destinations regardless of Mexico City’s growth. Instead, small shifts in new contracts or delivery mixes among Mexico’s major hubs will be a positive development, because it will diversify the national economy while also signaling to global outsourcing leaders that Mexico offers the rare ability to internally re-balance between delivery locations.

In the near term, software firms and business process firms looking to expand their footprint nearshore will be drawn to Mexico City because of its core strengths in human talent and synchronization with the U.S. economy. Tech wages that are lower in Mexico City will be an added sweetener. Yet, paradoxically, one of the secrets to Mexico City’s growth will be its enormous size, which fuels the widespread sense that the capital is not really a tech outsourcing market. Mexico City doesn’t come off as an IT outsourcing hub, which will only help to make its rising profile in the world of technology outsourcing.

(Photo: Francisco Diez)

Add comment